Lynden Energy Corp. (LVL) announced that they have tied three new Wolfberry wells into production for a total of eight gross wells. The first well is averaged 79 bo/d and 136 mcf/d over the first 32 days of production. The second well has averaged 49 bo/d and 71 mcf/d over the first 13 days. Lynden's third well is in the Wind Farms area and averaged 90 bo/d and 215 mcf/d over 22 days. Flow rates of all three wells appear to be improving with time. These three wells all appear to be successful and Lynden says that "initial results from the wells are very encouraging."

Lynden expects to drill one new Wolfberry well each month this year and seven new wells are expected to be spud by the end of May. Lynden's success with developing their Wolfberry project continues to derisk their land and increases the company's value. Their recent results validate Keith Schaefer's (Oil and Gas Investments Bulleting) low end valuation of their Wolfberry lands at $0.97/share.

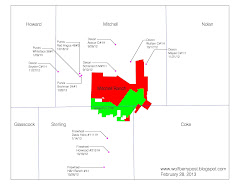

Lynden also announced that their first Mitchell Ranch "has been consistently producing oil and gas at rates that exceed the economic threshold." This is significant news as it's the first indication that the Mitchell Ranch could be a viable project. If they can continue this success with future wells, their valuation could be up to $20,000/acre for their Mitchell Ranch project ($20,000/acre x 50,000 acres = $1 billion).

Once the investment community finds out about Lynden, it's a good bet that their market cap will approach the numbers that others are getting for comparable land. This means that Lynden has the chance to increase by 10X!

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment