-

Gross producing wells expected to be 22

by 12/31/11 and 51 by 12/31/12.

-

Net producing wells expected to be 9.44

by 12/31/11 and 21.79 by 12/31/12.

-

Average production of 448 boe/d for

three month period ending 9/30/11.

-

Average selling price of natural gas,

$8.82/mcf! This is a great number

indicating the presence of liquids.

-

Earnings per share for the quarter

ending 9/30/11 are $0.05/share!

-

Revenues have increased from $668,862

(12/31/10) to $1,481,204 (3/31/11) to $1,869,753 (6/30/11) to $3,136,991

(9/30/11). This is an increase of 369%

since 12/31/10.

With the rapid development program on schedule for

2012, we should see revenues increase even more.Colin Watt, President and CEO of the company had these comments:

-

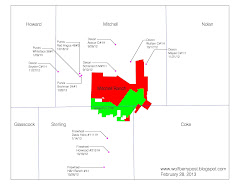

"We see potential to expand our

Wolfberry Project by upgrading the reserves through successful develoment

drilling."

-

"Our rapid oil and gas development

program is ongoing. Current plans call

for 31 gross Wolfberry Project wells to spud in 2012. This pace of development drilling will result

in significant increases in production rates in 2012."

Lynden is anticipating an exciting 2012 with significant growth and their enthusiasm permeates throughout their comments.

No comments:

Post a Comment