Tax loss selling appears to be dragging Lynden Energy Corp. down. Shares are trading in the $0.40 range giving the company a market cap below $40 million.

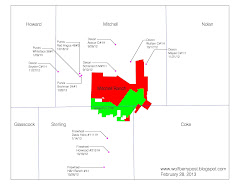

A $40 million market cap values the 3,841 acres that Lynden has at their West Martin and Wind Farms projects at $10,000/acre. The market cap does not reflect any value for the Tubb and Mitchell Ranch prospect areas. The West Martin and Wind Farms areas include 9.8 mmboe of proved and possible reserves for the company and is in an area where Wolfberry land is selling for up to $35,000/acre.

Given the proposed NCIB buyback that will be taking place shortly, current drilling of their West Martin and Wind Farms area, forthcoming results from their first Tubb well and exploration by Chesapeake Energy at Mitchell Ranch, Lynden's price appears ready to bounce. Now seems like the time to take advantage of tax loss selling and represents a tremendous buying opportunity!

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment