Thom Calandra wrote an article on Lynden Energy (click here to read it). He states that "should Mitchell Ranch prove up in terms of barrels of oil per day in a big way, Lynden's 50-cent shares will quadruple in short order."

One thing to note about Lynden that we have written about in the past is that Lynden has proved up a good portion of their West Martin and Wind Farms Wolfberry acreage. That acreage adds up to 3,841 acres and good Wolfberry acreage is selling at upwards of $35,000/acre these days. Adding in their 2,469 acres of Tubb Wolfberry land which they are currently drilling and Lynden's stock looks cheap! The valuation of their Wolfberry lands alone set a floor for the company's market cap and should they achieve success at Mitchell Ranch, Thom Calandra's statement about quadrupling could easily occur.

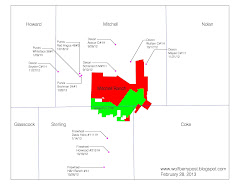

Chesapeake appears to be actively drilling at Mitchell Ranch, they have obtained several drilling approvals recently. Here is a summary of their drilling permit activity at Mitchell Ranch:

S149 Vertical Well (approved 8/1/11)

S150H Horizontal Well (approved 8/4/11)

S249 Vertical Well (approved 8/4/11)

S250H Horizontal Well (approved 8/4/11)

S350H Horizontal Well (approved 8/4/11)

S149 (amended 9/1/11)

S250H (amended 11/29/11)

S250HR Horizontal Well (approved 12/23/11)

S450H Horizontal Well (approved 12/27/11)

S450H (amended 1/10/12)

It is encouraging to see Chesapeake's recent drilling permit activity.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment