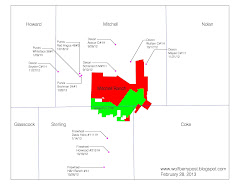

The Cline Shale has been called "one of the most under-appreciated plays in the U.S." and possibly "one of the largest oil plays in American history." If this turns out to be true, Lynden Energy Corp. could be sitting on one extremely valuable piece of property. Devon and Firewheel are drilling wells all around Lynden's Mitchell Ranch.

Back in April, we wrote about "How to Play the Cline." Given Lynden's holdings in the core Wolfberry and the activity by Cobra, Trilogy, Target, Apache, etc. in the vicinity, we believe that their Mitchell Ranch project value is not reflected in their stock price. With the latest excitement about the Cline Shale, Lynden's Mitchell Ranch could possibly be valued significantly higher than $5k/acre in the future. Could that value be $10k, $15k, $20k/acre or higher? Only time will tell.

Lynden's holdings include 6,730 net acres in the Wolfberry project and 34,150 net acres at Mitchell Ranch. This appears to be a classic case where the sum of the parts is greater than the whole. Both Mitchell Ranch and their Wolfberry projects separately could be valued higher than the current market cap. Just as the Cline Shale is one of the most under-appreciated plays, Lynden is one of the most under-appreciated stocks should they ever be able to monetize their assets.

Tuesday, December 11, 2012

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment