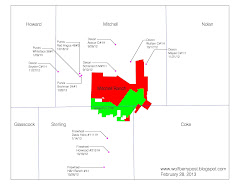

As you can see from the above map (LVL lands shown on map taken from Laredo's recent presentation), Lynden Energy Corp. has acreage located within the heart of the Wolfberry play with all of the large Wolfberry players surrounding them.

Given the two recent Permian Basin acquisition metrics of $38,600/acre and $47,826/acre, it's possible that Lynden could sell portions of their acreage for similar amounts. Here are valuations of each of Lynden's prospect areas based upon the recent transactions:

West Martin, 2,746 net acres @ $43,000/acre = $118 million

Wind Farms, 1,095 net acres @ $43,000/acre = $47 million

Tubb, 2,469 net acres @ $43,000/acre = $106 milllion

Lynden's Mitchell Ranch prospect area is within Devon Energy's delineation of the Cline Shale. Valuing that land at $5,000/acre equals $171 million (34,150 net acres).

Recent transactions are continually validating Lynden's land as viable Wolfberry acreage. With companies scrambling to assemble Wolfberry acreage positions, Lynden has a tremendous opportunity to capitalize!