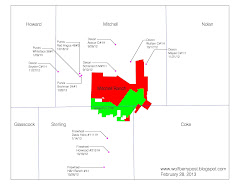

Should Chesapeake's share of Mitchell Ranch revert back to Lynden Energy and Crownquest, which is mentioned by Torrey Hills Capital and Keith Schaefer as a possibility, Lynden would have approximately 51,000 net acres at Mitchell Ranch. In addition, Lynden has approximately 5,966 net Wolfberry acres.

Lynden's recent transaction with Breitburn at $48k/acre and Diamondback Energy's recent Wolfberry transaction at $61.5k/acre demonstrate the potential of the Wolfberry acreage. One can determine Lynden's potential land valuation by assigning values to both their Woflberry and Mitchell Ranch acreage. Assigning $20k/acre to $40k/acre for the Wolfberry and $2k/acre to $5k/acre for Mitchell Ranch and dividing by 143.5 million shares results in potential valuations of $1.54/share to $3.44/share.

Lynden's exposure to these two plays makes this an interesting story with potential upside from the current $0.84/share price. Many people have touted Lynden Energy over the past year or so including Keith Schaefer of the Oil and Gas Bulletin, Torrey Hills Capital/Baby Bulls, Cormark, Thom Calandra, and Mat Wilson of Pinetree. Could this be Lynden's time?

Tuesday, April 1, 2014

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment